Set up a fundraising page online

Online via our website

Paying by BACS

Pay in collections by post

SUPPORTING US THROUGH ORIFLAME UK

"

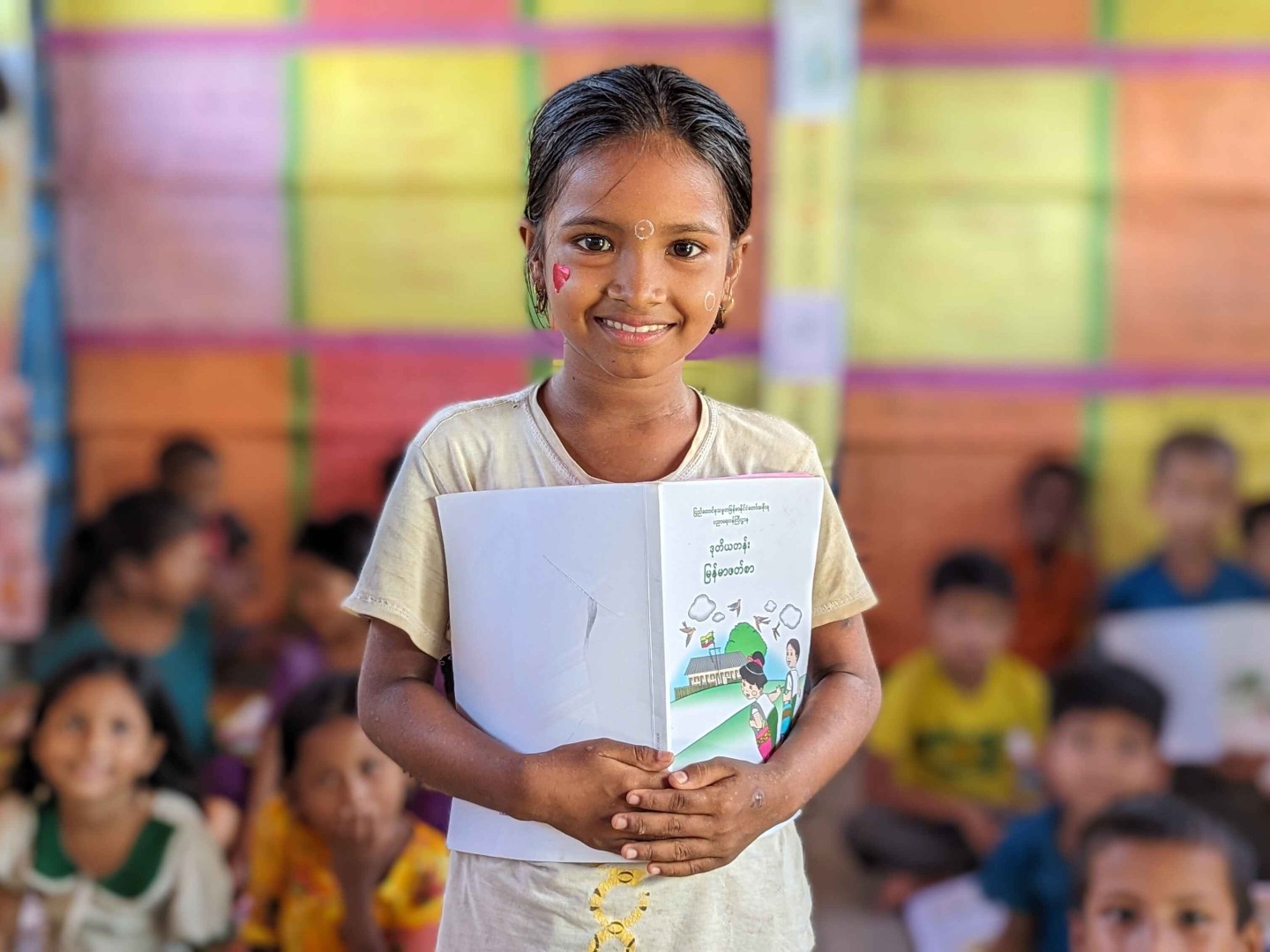

I can easily understand the video lessons, so I give my full attention to the class, and enjoy them. Video lessons have really increased my interest in coming to the learning centre and pursuing my education

"

Thank you for fundraising for Children on the Edge. With your support, we can continue to help children to safely live, play, learn and grow.